Mumbai, August 2023: One Point One Solution, the leader in BPM services, has declared its financial results for the Quarter ended June 30, 2023.

Mumbai, August 2023: One Point One Solution, the leader in BPM services, has declared its financial results for the Quarter ended June 30, 2023.

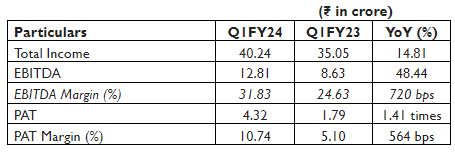

Q1FY24 – Financial Highlights

- Total Income was at ₹ 40.24 crore, as compared to ₹ 35.05 crore in Q1FY23, registered a growth of 14.81%

- EBITDA was at ₹ 12.81 crore, as compared to ₹ 8.63 crore in Q1FY23, registered a growth of 48.44%

- EBITDA Margin was at 31.83%, increased from 24.63% in Q1FY23

- Net Profit was at ₹ 4.32 crore, as compared to ₹ 1.79 crore in Q1FY23, grown by 1.41 times

Operational Highlights

- During the quarter the company has added logos in fast-growing BFSI and consumer segments

o India’s leading, Department for Promotion of Industry and Internal Trade (DPIIT), certified branchless banking and digital payments Network Company

o India’s leading new-age private sector Bank that offers banking solutions for retail, MSME, and corporate clients

o Large private-sector Bank which has over 1500 branches and caters to 7.5 million customers. It has total advances of over Rs. 200,000 crore. The company will handle the collection portfolio for the Bank’s growing credit card segment.

o India’s leading sleep and home solutions company. Under the terms of the agreement, the company will provide a range of BPM services, including customer support and order management

- Strengthens sales team by appointing John F Kennedy and Matthew Rupe to spearhead the growth strategy in the United States

o Kennedy has over 20 years of experience in striking deals in countries, such as the United States, United Kingdom, Philippines, Brazil, India, Mexico, and Canada. Prior to this, he worked with Hinduja Global Solutions as Vice President (Business Development). He had held the position of Director of Sales at Datamark Inc in Texas

Quote from the Management

Commenting on the Results, Mr. Akshay Chhabra, Managing Director said, “Delighted to declare peak performance during the quarter and this acts as a catalyst to maintain the pace for the entire year.

Happy to share that during the quarter we have added reputed corporates and leaders in their respective segments as a client. This has really helped us to strengthen our fast-growing segments like BFSI and Consumer segments.

The growth in the overall profits of the company would further improve as we expand into international markets and start signing clients during the current year.

As a part of our growth strategy, we would explore inorganic growth opportunities which are both revenue, and profitability accretive and helps in diversifying the current offerings to higher margins”.