24th August 2022, Mumbai: Protium, one of India’s fastest-growing finance companies with a razor-sharp focus on risk, today announced that they have disbursed greater than INR 3,000 crore in the last two years and have built a strong loan book of INR 1,750 Cr. Protium caters to the credit requirements of MSMEs, consumers as well as educational institutions across the country with their wide array of financial offerings including secured, unsecured as well as platform specific cashflow based products. Protium has serviced 500,000+ customers of which 1,00,000+ are MSMEs who have accessed credit in the range of INR 3 Lakh to INR 5 Crore.

Importantly, Protium remains significantly profitable while embarking on the growth path and investing in proprietary systems and technology. 80% of company’s loan book is also secured/asset backed with the lowest NPA of 0.22% as of the end of July 22. The company has 80+ branches spread across 60+ cities.

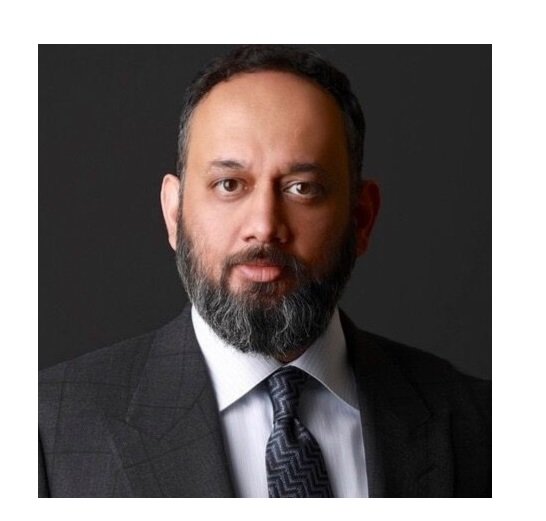

“The fundamentals of financing have not changed in a thousand years. Technology is table stakes at this stage of the game. The key differentiator is how does an organization fundamentally tie the two together – and this is where the DNA of a company really comes through. Throwing money and people at this problem is the wrong answer as many have found out. Also, At Protium, there is no such thing called growth unless it is weighed in by what risk it is coming at. Any financing company is only as good as the health of the portfolio they own and the core profitability metrics.,” says Peeyush Misra, Partner & Managing Director – Protium. Peeyush was a partner with global investment banking giant Goldman Sachs before starting Protium and comes with decades of global market expertise managing large balance-sheets and complicated risk books through periods of significant volatility.

Protium has also built a credit servicing and processing platform that helps their customers with quick and hassle-free loan processing of up to INR 30 Lakhs in less than 5 minutes using their cutting-edge technology system, “TURIYA”, which is completely build inhouse. This hybrid model of combining offline and online operations helps Protium reach out to millions of customers while maintaining a high focus on both risk and growth simultaneously.

The company’s core focus remains on risk management, with majority of senior management coming from risk and capital committing backgrounds. This has enabled Protium to achieve best in class gross NPA of 0.22%, which is remarkable given the challenges the economy has faced over the last 2-3 years. With more than 80% of its loan book in the secured/asset-backed bucket, Protium is poised to fulfill its aim of having a “Fortress Balance sheet” while fulfilling its aspiration to fuel the ambitions of millions of Indians through powerful financing solutions.

“It was a conscious decision to ensure that at least 80% of ours is asset-backed, even if that meant disbursals were not as aggressive as they could have been. We do not believe in quick growth hacks. As the name Protium suggests, it is important to be obsessed with fundamentals and we use first principles to solve any complicated problems that may arise,” Peeyush added.

With growing in-house tech capabilities and best-in-class risk assessment, Protium is poised to bring powerful financing within the reach of millions of Indian small businesses and households.

Currently, the company employs 1,600+ employees across 60+ cities. Recently, Protium had made headlines for its attention to employee wellbeing and welfare. The policies they released for their female employees during Women’s Day were widely applauded by experts across the industry.

Protium is making strong inroads in consumer business through Protium Money, which is Protium’s consumer lending handle. The financing company expects Protium Money to lead its next phase of growth and take its offerings to hundreds of millions of Indian households. When asked to comment on its growth plans for the consumer product, the company however stated that it’s way too early to comment on the path ahead, but the organization is looking forward to developments in the consumer business side. It will be exciting to see how Protium replicates its success in small business lending across its consumer business. This may be a tall order for many companies but well within reach for a company that has managed to build a loan book of INR 1,750 crore in less than 24 months with an NPA of 0.22%.