Business Performance

- Global Advances of the Bank increased to INR 8,18,120 crore, +8.9% YoY and 6% QoQ as of Mar’22.

- Domestic Advances of the Bank increased to INR 6,84,153 crore, +6.7% YoY and 4.6% QoQ as of Mar’22

- Global Deposits increased by 8.2% YoY to INR 10,45,939 crore. Domestic Deposits increased by 8.0% YoY to INR 9,27,011 crore in Mar’22.

- Domestic Current Account Deposits stands at INR 68,780 crore, registering a robust growth of 11.6% on a YoY basis.

- Domestic Savings Bank Deposits grew by 11.4% to INR 3,41,343 crore. Overall Domestic CASA registered a growth of 11.4% on a YoY basis.

- Organic Retail loan portfolio of the Bank grew by 16.8% led by growth in Personal loan portfolio by 108.1%, Auto loan by 19.5% and Education loan by 16.7% on a YoY basis.

- Agriculture loan portfolio grew by 10.3% YoY to INR 1,09,796 crore

Profitability

- Net Interest Income grew by 21.2% to INR 8,612 crore in Q4FY22 and 13.2% YoY to INR 32,622 crore in FY22.

- Fee Income for the year grew by 12.6% YoY at INR 6,409 crore and 5.8% YoY for the quarter to INR 1,848 crore.

- Operating Income for FY22 registered a growth of 5.7% YoY at INR 44,106 crore.

- Cost of Deposits reduced to 3.53% in Q4FY22 as against 3.71% in Q4FY21.

- Operating Profit for FY22 stands at INR 22,389 crore registering a growth of 5.6% YoY.

- Bank reported a standalone Net Profit of INR 1,779 crore in Q4FY22 as against a loss of INR 1,047 crore in

- Q4FY21.The Net Profit for FY22 increased to INR 7,272 crore in Mar’22 (777%) from INR 829 crore in FY21.

- Global NIM increased to 3.08% in Q4FY22 from 2.72% in Q4FY21.

- Return on Assets (RoA) improved to 0.60% in FY22 from 0.07% in FY21.

- Return on Equity (RoE) increased sharply by 1016 bps YoY to 11.66%

- For the consolidated entity, Net Profit stood at INR 7,850 crore in FY22 as against INR 1,548 crore in FY21.

Asset Quality

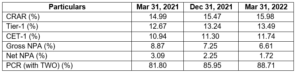

- The Gross NPA of the Bank reduced to INR 54,059 crore in Q4FY22 from the level of INR 66,671 crore in Q4FY21 and Gross NPA Ratio improved to 6.61% in Q4FY22 from 8.87% in Q4FY21.

- The Net NPA Ratio of the Bank improved to 1.72% in Q4FY22 as compared with 3.09% in Q4FY21.

- The Provision Coverage Ratio of the Bank stood at 88.71% including TWO and 75.28% excluding TWO in Q4FY22.

- Slippages for the year was contained at 1.61%.

- Credit cost for the year was at 1.95%, however adjusted for prudential provisioning, pro-forma credit cost was 1.70%.

Capital Adequacy

- CRAR of the Bank improved to 15.98% in Mar’22 from 14.99% in Mar’21. Tier-I stood at 13.49% (CET-1 at 11.74%, AT1 at 1.75%) and Tier-II stood at 2.49% as of Mar’22.

- The CRAR and CET-1 of consolidated entity stands at 16.47% and 12.34% respectively