Jaipur, January 31, 2024: Shriram General Insurance Company (SGIC) on Tuesday announced that its Gross Written Premium (GWP) during Q3 FY24 has increased by 41% to Rs 850 crore, over the same period last year. The company wrote 1681086 policies in Q3 FY24 and earned a net profit of Rs. 117 crore during the third quarter of FY24, a 51% increase YoY owing to a growth in GWP YoY and better claims management. The company has settled 47006 claims during Q3 FY24, compared to 38937 in the year-ago period.

Jaipur, January 31, 2024: Shriram General Insurance Company (SGIC) on Tuesday announced that its Gross Written Premium (GWP) during Q3 FY24 has increased by 41% to Rs 850 crore, over the same period last year. The company wrote 1681086 policies in Q3 FY24 and earned a net profit of Rs. 117 crore during the third quarter of FY24, a 51% increase YoY owing to a growth in GWP YoY and better claims management. The company has settled 47006 claims during Q3 FY24, compared to 38937 in the year-ago period.

The company has maintained an augmented solvency ratio of 4.30 as of December 2023 (from 4.63 a year ago) as against the regulatory requirement margin of 1.5.

Segment-wise GWP during Q3 FY24

- Motor: Rs 779 Cr (Rs 549 Cr in Q3FY23, 42% growth YoY)

- Personal Accident: Rs 33 Cr (Rs 21 Cr in Q3FY23, 57% growth YoY)

- Fire: Rs 24 Cr (Rs 21 Cr in Q3FY23, 14% growth YoY)

- Engineering: Rs 5 Cr (Rs 4 Cr in Q3FY23, 25% growth YoY)

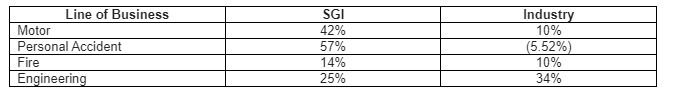

Business line growth as against industry during Q3 FY24:

Anil Aggarwal, MD & CEO, of Shriram General Insurance Company, said, “This year we had a focus shift towards increasing the Gross Written Premium. Also, the company is entering into newer areas like EV insurance and developing combo insurance plans. It is also aiming to increase the non-motor folio. We anticipate a growth of 37% in our non-motor business this year and are aiming to further this to 30% next year.

The insurer, jointly owned by Shriram Group and Africa’s Sanlam Group, said that 83% of all its policies were sold through digital mode and has unveiled a new health product during the last quarter. “We recently introduced Shri All Benefit Health Insurance (ABHI) Group Policy, an umbrella product that provides 21 benefit-based products/add-ons.”

The company has a current workforce of 3885 and plans to hire an additional 700 next financial year. The insurer has furthered its operations by opening 28 new branches in the last 9 months across India.