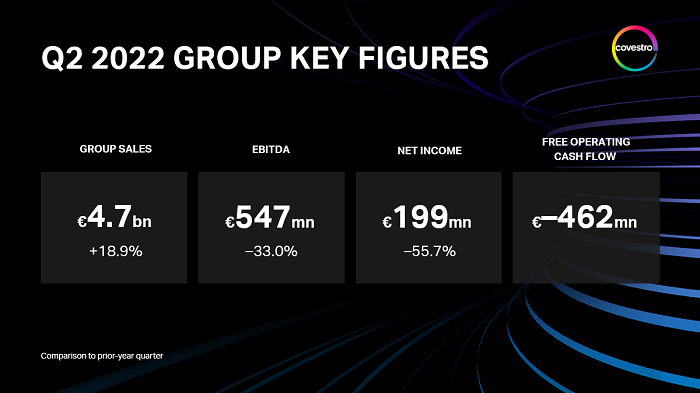

Covestro continued its successful start to the current fiscal year in the second quarter of 2022. The Group’s sales increased by 18.9 percent compared with the prior-year quarter to EUR 4.7 billion (previous year: EUR 4.0 billion), in particular on the back of higher average selling prices. EBITDA fell in the second quarter by 33.0 percent to EUR 547 million (previous year: EUR 817 million). This was mainly due to significantly higher raw material and energy prices, which were partially offset by a higher selling price level, and to lower volumes sold. The free operating cash flow (FOCF) fell to EUR –462 million (previous year: EUR 374 million). That is mainly attributable to an increase in funds tied up in working capital, especially due to the payment of short-term variable compensation for fiscal 2021, and to lower EBITDA. Net income in the second quarter of 2022 fell by 55.7 percent compared to the very strong prior-year quarter and was EUR 199 million (previous year: EUR 449 million).

“We can look back at what was overall a solid second quarter, and we even slightly surpassed our EBITDA forecast. Nevertheless, we are looking ahead to an increasingly challenging second half of the year. The current geopolitical situation shows us all too clearly that there is no alternative to the transformation toward a sustainable, fossil-free industry landscape,” said Dr. Markus Steilemann, CEO of Covestro. “With our vision of becoming fully circular and our ambitious climate targets, we are underscoring our position as a forerunner on the path toward a climate-neutral future.”

Full-year guidance 2022 adjusted

The Russian war against Ukraine has fundamentally changed the geopolitical situation and caused extensive consequences for the global economy. The Group therefore expects continued impacts on global supply chains, very high energy price levels, high inflation and weaker growth in the global economy.

As a consequence of a recent significant further increase in energy costs and a further weakening global economy, Covestro adjusted its outlook for the current fiscal year on July 29, 2022. The Group anticipates that EBITDA will be between EUR 1.7 billion and EUR 2.2 billion (previously: between EUR 2.0 billion and EUR 2.5 billion) and ROCE above WACC between minus two and two percentage points (previously: between one and five percentage points). The FOCF is now expected to be between EUR 0 million and EUR 500 million (previously: EUR 400 million and EUR 900 million). Covestro expects greenhouse gas emissions to fall to between 5.3 million and 5.8 million metric tons (previously: between 5.5 million and 6.0 million metric tons). The Group anticipates EBITDA for the third quarter of 2022 will be EUR 300 million to EUR 400 million.

“In the second quarter we benefited from a faster than expected recovery after the lockdowns in China and an intact demand for our products,” said Dr. Thomas Toepfer, CFO of Covestro. “In this second half of the year, the macroeconomic risks have once again increased significantly, particularly with regard to the very high energy costs and uncertainties in gas supply at our German sites.”

The company’s German sites account for around a quarter of global production capacity. Covestro is initiating various measures to reduce its gas requirements in Germany in the short term, such as by switching to oil-based steam generators. In addition, the company is continuously working to improve existing production technologies and roll out new ones in order to further reduce gas and energy consumption. If gas supplies are rationed in the further course of the year, this could result in partial load operation or a complete shutdown of individual Covestro production facilities, depending on the level of the cutback. Due to the close links between the chemical industry and downstream sectors, a further deterioration of the situation is likely to result in the collapse of entire supply and production chains.

Continued focus on the circular economy and climate neutrality

Covestro has implemented further measures to drive its vision of becoming fully circular and achieving climate neutrality by 2035. In May 2022, for example, the company launched “CQ” – “Circular Intelligence”, a new concept that makes circular solutions in the product portfolio even more visible to customers. That means Covestro will in the future highlight the alternative raw material base for its products if it is at least 25 percent. One of the first “CQ” products is Desmodur®CQ. Polyurethanes based on Desmodur®CQ are used in upholstered furniture, mattresses or thermal insulation, among other things.

In June 2022, Covestro also opened a new Wind Technology Center in Leverkusen, where the company is conducting research into material solutions for sustainable energy generation from wind power. The focus is on faster and more cost-effective production of rotor blades and optimization of their blade properties. In this way, the service life and thus also the energy yield can be increased in order to drive the expansion of alternative energies.

Both segments post sales growth

Sales in the Performance Materials segment in the second quarter of 2022 rose by 25.8 percent compared to the prior-year quarter and were EUR 2.5 billion (previous year: EUR 2.0 billion), in particular on the back of a higher selling price level. Logistical bottlenecks caused by lockdowns due to the pandemic in China limited the segment’s further growth particularly in the APAC region. EBITDA in Performance Materials fell by 43.0 percent to EUR 367 million (previous year: EUR 644 million), mainly due to lower margins. The free operating cash flow fell to EUR –37 million (previous year: EUR 373 million), largely due to the lower EBITDA and an increase in funds tied up in working capital.

The Solutions & Specialties segment posted an 11.0 percent increase in sales to EUR 2.2 billion in the second quarter of 2022 (previous year: EUR 2.0 billion). A rise in the selling price level and exchange rate effects helped increase sales. The segment’s EBITDA fell to EUR 213 million, or by 10.1 percent compared to last year’s second quarter (previous year: EUR 237 million). This was mainly due to a decline in volumes sold and lower margins. The free operating cash flow of Solutions & Specialties fell to EUR –139 million (previous year: EUR 29 million), likewise due to an increase in funds tied up in working capital.

High selling price level impacts first half of 2022

Group sales in the first half of 2022 increased by 29.2 percent to EUR 9.4 billion (previous year: EUR 7.3 billion). That was due to a higher selling price level, exchange rate movements and the portfolio change arising from the acquisition of the Resins & Functional Materials (RFM) business from DSM. Due to higher raw material and energy prices, which however were able to be partially offset by the higher selling price level, the Group’s EBITDA in the first half of 2022 declined by 13.3 percent to EUR 1.4 billion (previous year: EUR 1.6 billion). Net income in the first half of 2022 was EUR 615 million (previous year: EUR 842 million), while the FOCF fell to EUR –445 million (previous year: EUR 692 million).