Federal Bank announced its audited financial results for the quarter and year ended 31 st March 2022

today.

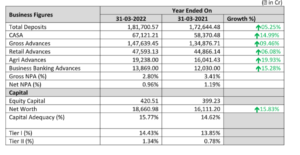

Highlights

-

- Net Profit @ ₹ 541 Cr, grew by 13% YoY

• ROA for Q4 at 1.03% and ROE at 11.93%

• CASA grew by 15% YoY and CASA Ratio at all-time high level of 36.94%

• The Capital Adequacy Ratio (CRAR) of the Bank stood at 15.77%, up by 115 bps YoY

• Core Fee Income @ ₹453 Cr, increase of 25% YoY & 10% QoQ

• GNPA and NNPA brought down to 2.80% and 0.96% respectively

• Agri Business grew by 20% YoY

• Business Banking grew by 15% & Commercial Banking grew by 12% YoY

• Market Share in Personal Inward remittance business at 20.16% (Q3 FY22)

- Net Profit @ ₹ 541 Cr, grew by 13% YoY

Commenting on the results and financial performance, Mr. Shyam Srinivasan, Managing Director & CEO, Federal Bank said, “Notwithstanding the turbulent times outside, we have delivered an encouraging performance for FY22. Despite the absorption of a large one-off expense, the ROA and ROE have met the guided levels of 1.03% and 11.93% respectively. The Bank also registered its highest ever Net Profit for a quarter @ ₹ 541 Cr. Asset quality of the Bank has been resilient and demonstrates the underwriting, monitoring and collection capabilities of the Bank. Credit cost for FY22 was at a new low at 45 bps. We have played the turbulent times reasonably well and are now on the path to sustained growth momentum with various enablers in place.”

Working Results at a Glance

(₹ in Crore)

OPERATING REVIEW

Total Business

The total business of the Bank reached ₹ 3,29,340.02 Cr as on 31 st March 2022 from ₹ 3,07,521.19 Cr as

on 31 st March 2021, registering a growth of 7.10%.

Credit Growth

Gross Advances reached ₹ 1,47,639.45 Cr as on 31 st March 2022 from ₹ 1,34,876.71 Cr as on 31 st March

2021 registering a growth of 9.46%. Agri Advances registered a growth of 19.93% to reach ₹ 19,238.00

Cr from ₹ 16,041.43 Cr. Business Banking Advances registered a growth of 15.00% to reach ₹ 13,869.00

Cr. Commercial Banking Advances registered a growth of 12.00% to reach ₹ 14,806.00 Cr.

Deposit Growth

Deposits recorded a growth of 5.25% to reach ₹ 1,81,700.57 Cr as on 31 st March 2022 from ₹

1,72,644.48 Cr as on 31 st March 2021. The CASA deposits reached ₹ 67,121.21 Cr as on 31 st March 2022.

CASA Ratio stands at 36.94%. Resident Savings Bank deposit registered a growth of 16.04% to reach ₹

29,953.44 Cr as on 31 st March 2022.

Operating Profit & Net Profit

The Bank delivered an annual operating profit of ₹ 3,757.85 Cr as on 31 st March 2022. The annual net

profit is at ₹ 1,889.82 Cr as on 31 st March 2022 up from ₹ 1,590.30 Cr as on 31 st March 2021.

Income & Margins

Annual Net Interest Income increased from ₹ 5,533.71 Cr to ₹ 5,961.96 Cr registering a growth of 7.74%

as on 31 st March 2022. Net Interest Margin stood at 3.20 % for FY22. Net total income registered a

growth of 7.46% to reach Rs. 8,051.05 Cr.

Asset Quality

The Gross NPA of the Bank as on 31 st March 2022 stood at ₹ 4,136.74 Cr. Gross NPA as a percentage to

Gross Advances is 2.80% as on 31 st March 2022. The Net NPA stood at ₹ 1,392.62 Cr and Net NPA

percentage is at 0.96% as on 31 st March 2022. The Provision Coverage Ratio stood at 65.54% as on 31 st

March 2022.

Capital Adequacy & Net worth

The Capital Adequacy Ratio (CRAR) of the Bank, computed as per Basel III guidelines, stood at 15.77% as on 31 st March 2022, up by 115 bps YoY. The Net Worth of the Bank was at ₹ 18660. 98Cr as on 31 st

March 2022.

Dividend

The Board of directors at its meeting held today has recommended a dividend of 90% per equity share

having face value of 2 for the year ended 31st March 2022. The dividend will be paid after the approval

of shareholders at the Annual General Meeting.

Awards & Accolades

Won Finnoviti Award instituted by Banking Frontiers for ‘Fed-E-Studio’, the self-service banking

kiosk for customers

Won the award for Best use of Cloud in Banking at the 3rd Annual BFSI Technology Excellence

Awards 2022

Winner of ‘Best Fintech Adoption’, runner up for ‘Best Technology Bank of the Year’, and special

mention award for ‘Best Cloud Adoption’ at IBA’s 17th Banking Annual Technology Awards

Winner of Finacle Client Innovation Awards in the mid-size bank segment in 5 categories namely

Corporate Banking Digitization (Automatic Opening of Accounts through BPM), Customer Journey Reimagination (Fed-e-Point self-service customer portal), Modern Technologies-led Innovation (AI based Digital Lending Platform), Process Innovation (Be Your Own Master – Top Up Demand Loan) and Product Innovation (Cross Border Remittance Automation and Insta- Demat). The Bank also emerged as a runner up in the category Ecosystem-led Innovation (Neo- Banking)

Recognized as the ‘Best mid-sized Bank’ in the 26th & Business Today – KPMG Annual Survey

Recognized as a Great Place to Work in a study conducted by the Great Place to Work® Institute

for the second time in a row

Major Partnership

Partnered with Mashreq Bank to facilitate NR account opening for Indians in UAE, making it first

of its kind

Partnered with BSE to promote listing of SMEs & Start-Ups

Partnered with Central Board of Indirect Taxes and Customs to help customers pay their taxes

through various channels of the Bank

Footprint

The Bank has 1282 branches, 1885 ATMs/ Recyclers as on 31 st March 2022. The Bank also has its Representative Offices at Abu Dhabi and Dubai and an IFSC Banking Unit (IBU) in Gujarat International

Finance Tec-City (GIFT City).

Q4FY22 Vs Q4FY21

Resident Savings Bank deposit registered a growth of 16.04% to reach ₹ 29,953.44 Cr

Total Deposits grew from ₹ 1,72,644.48 Cr to ₹ 1,81,700.57 Cr registering a growth of 5.25%

CASA recorded a growth of 14.99% to reach ₹ 67,121.21 Cr

NRE deposits reached ₹ 67,416.25 Cr from ₹ 63,958.84 Cr registering a growth of 5.41%

CV/CE advances grew 40.11% to reach Rs. 1275.00 Cr

Gross Advances increased from ₹ 1,34,876.71 Cr to ₹ 1,47,639.45 Cr registering a growth of

9.46%

Business Banking Advances and Commercial Banking Advances grew 15.00% and 12% to reach ₹

13,869.00 Cr and ₹ 14,806.00 Cr respectively

Agri advances reached ₹ 19,238.00 Cr from ₹ 16,041.43 Cr registering a growth of 19.93 %

Major Financial Indicators (Standalone Nos.)

(₹ in Cr)